Thomas Doe

Social WorkerNulla totam rem metus nunc hendrerit ex voluptatum deleniti laboris, assumenda suspendisse, maecenas malesuada morbi a voluptate massa! Hendrerit, egestas.

The net of these two figures is typically reported on a third line. Including contra revenue accounts is important in the income statement because it shows the original amount of sales the firm has made, along with any factor that has reduced that amount. Allowance for doubtful accounts (ADA) is a contra asset account used to create an allowance for customers who are not expected to pay the money owed for purchased goods or services. The allowance for doubtful accounts appears on the balance sheet and reduces the amount of receivables. The contra equity account treasury stock is reported right on the balance sheet.

Writing off your obsolete inventory in this manner allows you to expense the cost of the obsolete inventory while also decreasing your current inventory balance using the contra asset account. The accumulated depreciation account is perhaps the most common contra asset account used by business owners. Contra assets may be stated in separate line items on the balance sheet. Or, if they contain relatively minor balances, they may be aggregated with their paired accounts and presented as a single line item in the balance sheet. In either case, the net amount of the pair of accounts is referred to as the book value of the asset account in question. When a contra asset account is not stated separately in the balance sheet, it may be worthwhile to disclose the amount in the accompanying footnotes, where readers can readily see it.

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. This first criterion means that the car will have a net value or book value of $0 once it is fully depreciated. The main https://www.bookstime.com/ reason is to make the remaining shares more valuable, as their prices are expected to rise after the stock buyback. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

Sometimes, both accounts can be written in a single line if they don’t represent a large portion of the assets. In case the contra asset account is not listed in the balance sheet, it must be listed in the footnotes of the financial statement for the users to be informed. Another contra asset account is Allowance for Doubtful Accounts. This account appears next to the current asset Accounts Receivable.

Contra asset accounts are a type of contra account that net off against asset accounts. These include accumulated depreciation, accumulated amortization, allowance for receivables, obsolete inventory, and discount on notes receivables. To illustrate, let’s use the contra asset account Allowance for Doubtful Accounts.

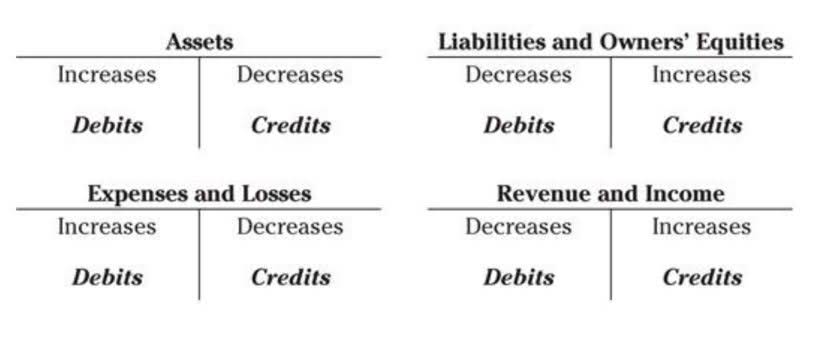

An entry will be recorded on the credit side if and when a debit entry is recorded in an account and vice-versa. This will repeat until the machinery has been totally depreciated, sold, or retired. Learn why contra accounts, when utilized correctly along with a paired account, are a crucial component of accurate accounting and financial review. For example, an asset was purchased by a company for $100,000 – that is, the historical cost of the asset was $100,000 – and its contra asset counterpart has a balance of $30,000. Therefore, the asset’s net value (or the book value) will be $70,000.

For example, accumulated depreciation will go along with related assets. Therefore, contra-asset accounts differ from other accounts that have a credit balance. The contra asset account, accumulated depreciation, is always a credit balance. This balance is used to offset the value of the asset being depreciated, so as of September 1, your $8,000 asset now has a book value of $7,866.67. In accounting, assets are things of value that your business owns. Your bank account, the inventory you currently stock, the equipment you purchase, and your accounts receivable balance are all considered asset accounts.

Thus, netting off both will result in the final amount for the account. The net of the asset and its related contra asset account is referred to as the asset’s book value or carrying value. Contra asset accounts are reported with the related account on the same financial statement. Those who are struggling with recording contra accounts may benefit from utilizing some of the best accounting software currently available. When accounting for assets, the difference between the asset’s account balance and the contra account balance is referred to as the book value.

The debit balance of the asset account and the credit balance of the contra asset account determine the net value of the asset. Normal asset accounts have a debit balance, while contra asset accounts are in a credit balance. Therefore, a contra asset can be regarded as a negative asset account. Offsetting the asset account with its respective contra asset account shows the net balance of that asset.

Mutual fund folio growth: here is how the September 2023 story ….

Posted: Wed, 11 Oct 2023 13:05:00 GMT [source]